2023 - A Year in Review

Published 22-DEC-2023 13:54 P.M.

|

12 minute read

This year was full of ups and downs.

Companies beating our expectations... or failing them.

Surprising us, delighting us, frustrating us...

But always keeping us entertained.

One of the best things about investing in the small cap markets - there is nearly always something interesting happening.

The year was particularly weak for small caps, off the back of one of the fastest interest rate hiking cycles the country has ever seen.

In the year gone by, we have seen many companies make significant progress...

But have not been rewarded with share price rises as the majority of investors remain risk off for small cap stocks.

But investing is by nature counter cyclical.

We apply the “fortunes are made in the down market and harvested in the up market” mantra.

Just like in the COVID crash of 2020, our goal this year was to deploy capital and make new Investments.

No one can really predict when the small cap market will turn bullish again (a 2024 drop in interest rates?), but we want to be well positioned when it does.

We launched nine new investments across our Portfolios in 2023 - with a key focus on lithium, uranium and biotechs.

We also increased our position in existing portfolio stocks - most of which raised at “down-rounds”.

The year started in Angola, where we visited MNB’s phosphate and green ammonia projects (MNB will be one to watch in 2024).

And the year ended with IVZ announcing a DISCOVERY after over 10 long years (also one to watch next year).

And in between, there were offtakes, JORC resources, discoveries, dusters, hundreds of thousands of metres drilled.

New projects, new management, new commodities in favour, some went out of favour.

Uranium was up, graphite was down.... then up again.

Gold started down and finished the year very strong.

Oil & gas was always lurking, and lithium was still king, especially in WA...

ALA, ONE and LRS were the stand out performers across our Portfolio.

TMR, TMZ and BOD also stood out... but for the wrong reasons.

DXB signed a $230M commercialisation deal BEFORE any results from its phase III FSGS clinical trial.

And LRS published its Preliminary Economic Assessment within 18 months of making a discovery.

Fast movers.

EV1 got its Framework Agreement, and TYX got its major funding partner.

EXR found free-flowing gas - an unexpected positive.

NHE... well, we’ll need to wait till January to know exactly what NHE found (we are hoping NHE can surprise us on the upside in January).

Major Automaker Stellantis invested $7.8M in... KNI

(Amazing, considering KNI’s tiny market cap and Stellantis is capped at $66B).

And the founder of Australia’s biggest food distributors took a large position in our orange juice producer OJC.

TTM published a JORC resource of 3.0M oz gold.

PUR, SGA, GAL and GTR all put out JORCs of their own.

88E had its annual drilling event in the North Slope of Alaska...

LCL drilled in Papua New Guinea - with strong results.

LNR and LYN had a few cracks at exploration drilling (with limited success).

That’s okay, because that’s the game we play - exploration is always a roll of the dice, and small cap companies live to roll another day.

The biggest surprise might have come from the “little explorer that could” - TG1 - who managed to pull a WA lithium project from its back pocket after struggling to raise capital just 3 months beforehand.

(TG1 is drilling it in February... we are quite excited about this.)

USA “Brine Brothers” MAN and PFE started exploring for lithium brines in old oil fields - getting ahead of oil supermajor Exxon’s entry into the space.

While PUR developed its own brine project in the “Lithium Triangle” in Argentina.

And BPM did... not much.

We are still one of BPM’s biggest shareholders and want to see them find an exciting new project.

Breaking up is always hard.

Our Investments FYI and PRL both broke up with their major partners.

(FYI broke up with Alcoa and PRL broke up with Total Eren).

PRL remains in suspension pending its re-compliance as a “hydrogen company” (to be done after its PFS) and we look forward to them relisting again next year.

IRD’s Cape Hardy was selected as the site for the Northern Water desalination plant... but they weren’t told about it...

And WHK finished the year strong with a US$1.2M per year contract with a “top 5 social media company” that they can’t reveal.

If you’re wondering who it could be, chuck “top 5 social media company” into Google, it’s likely one of those.

SGA finally cracked the metwork code on its giant graphite resource, achieving “battery grade” graphite before the year was up.

While VUL continued to develop its Zero Carbon Lithium project.

EMN secured US$100M in funding to recycle manganese from mine tailings... and that’s non-dilutive funding by the way.

Due to the low market sentiment in 2023, bad news was punished and good news was also met with selling as investors used the liquidity to take precious cash off the table.

So with companies making great progress but share prices not reflecting it, 2023 was a good time to add new Investments and increase positions in existing investments.

New Investments we made include MEG, REZ, GUE, SLM, HAR, HVY, NTI, EMD and GLV.

Best performer in the “Class of 2023” was HAR, up 73% from our Initial Entry Price.

Special mention to SLM as well, which was up by as much as 570% in mid-June but, unfortunately, is now trading under our Initial Entry Price after less than favourable drill results led to them going “back to the drawing board” with a new project.

We have not sold a share in SLM - we are backing their management team and their links to LRS to be able to pull a lithium “rabbit out of the hat” in Brazil.

We participated in capital raisings in LNR, LYN, LCL, GTR, TMR, IVZ, DXB, WHK, 88E, EXR, GUE, SLM, IVZ again, IVZ a third time, TG1, ALA, NHE, BOD, and PFE.

Oh, and IVZ a fourth time (in the current round).

Remember, you can always find our current holdings at any time here: Next Investors Holdings.

If you are a s708 sophisticated investor and interested in placements, Next Cap Raise tries to get allocations in these deals to offer to its subscribers - you can register here.

It was a big year in small cap land and while share prices may not reflect it for all of those companies, a lot of them did make a lot of great progress fundamentally.

We are looking forward to 2024 - a year we hope small cap sentiment starts to improve and share prices begin to reflect the value these companies have built over the last 12 months.

Today we will look at some of the key progress for the stocks in our Portfolio and crown our “best stock of 2024”.

Our Best stocks of the year:

Winner: Arovella Therapeutics (ASX:ALA)

ALA was our best performing stock of 2023, up 475% since Jan-2023.

Yesterday we published an in-depth analysis as to why we think 2023 was such a good year for the company, and what we are expecting in 2024.

Read the full article here: ALA is our best performing stock in 2023 - here’s why, and what to expect in 2024

Ultimately it came down to the company exceeding expectations by delivering material progress and communicating that progress to investors.

We also think that the ALA share register has been set up well, with the stock tightly held by both cornerstone investor Merchant Group and other investors who are in the company for the “long haul”.

Runner Up: OneView Healthcare (ASX:ONE)

Up 118% since Jan 2023, ONE was the second best performing stock in our Portfolio for 2023.

Towards the end of 2022 ONE was sold off heavily.

We think that this was due to interest rate tightening, a broader sell off in all tech stocks and investors being “risk off” for speculative tech investments.

However, ONE managed to shake off any doubters achieving the 15,000 beds milestone that we set in our initial investment memo and signing a key deal with NYSE listed, $20BN capped Baxter Group.

We caught up with ONE CEO James Fitter a few weeks ago, and think that this Baxter deal can be a game-changer for the company.

That’s because Baxter sells equipment to 75% of US hospitals, providing ONE a direct sales line into a notoriously “difficult to break into” industry.

We think that 2024 will be a big year for ONE.

Worst stocks - TMZ, BOD, TMR

It always stings when an investment goes pear shaped.

That is why both TMZ and BOD share the award for worst stock of the year.

TMR also has been one of our worst performing Investments, with the company publishing a JORC resource after four years of drilling that actually downgraded the previous resource estimate.

We still hold on to all three companies but have moved them all into our Bottom Drawer Portfolio.

Our “Bottom Draw Portfolio” is our list of Investments that we still hold but have failed to make meaningful progress towards our “Big Bet”.

This is generally due to a key risk materialising.

We still watch our Bottom Drawer stocks closely, in the hope that they pull a rabbit out of the hat and return to the main Portfolio.

(For example a recapitalisation and a new project that we like).

Our Portfolio by the numbers

This year was a big year for our Portfolio, and it can be easy to forget all of the material progress that the investments make.

Again, 2023 was a “risk off” year in the small cap market, and positive developments were often sold into, with share prices not reflecting the progress.

(we are hoping sentiment improves in 2024 and share prices eventually start to reflect the progress made during 2023)

So, here are some highlights from our Portfolio...

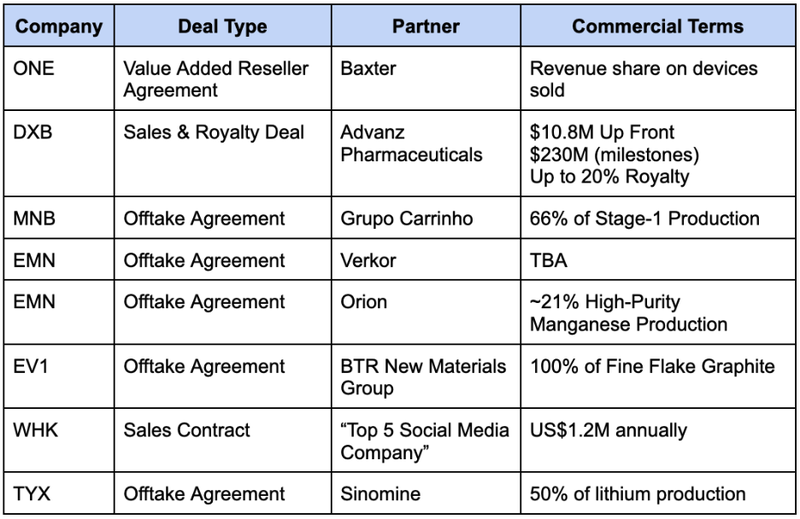

Big Deals

Commercialisation

A few of our Portfolio companies signed key commercialisation deals.

These deals can take months and even years to negotiate - they are hard to get.

For pre-revenue small cap companies (like most of the ones we Invest in), these commercialisation deals are very important, as they highlight a pathway to project revenue.

Here are the key commercialisation deals signed this year:

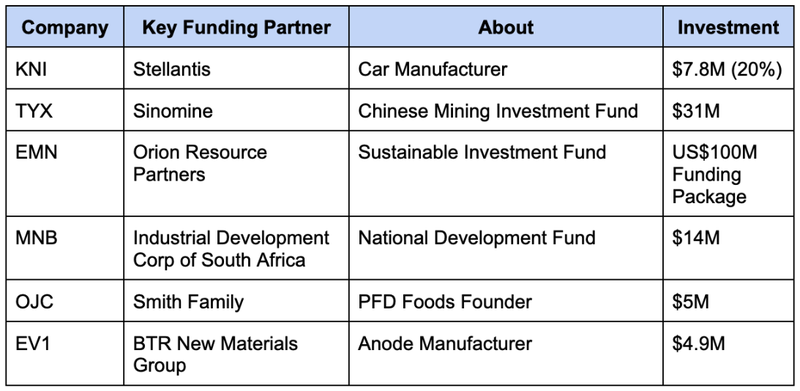

Key Project Funding

The companies that we Invest in mostly operate on a “raise and spend” cycle.

But sometimes, there is a key funding partner that comes along and makes an investment that allows the company to go to the next level with its project.

These key funding partners are important because they tend to be “sticky” holders and are patient with their capital as the company delivers on its project.

Here are the key funding deals signed this year:

Project Acquisition

Although dilutive for the company, finding the right project can breathe new life and bring in new investors for small cap stocks.

These projects take time to find, and can be “game changing” if they deliver early results.

You only see the projects that companies DO acquire, but not the many other projects that were rejected.

Although a new project can be a pivot away from the core asset, if the management team is solid and the capital structure remains reasonable, we are flexible enough to back the management to deliver on a new project.

Here are the new projects that were acquired this year:

Notable mentions to KNI that secured an option on a lithium project in Canada and decided NOT to follow through with the acquisition.

Sometimes it is the projects that you don’t take that end up being the best value for shareholders.

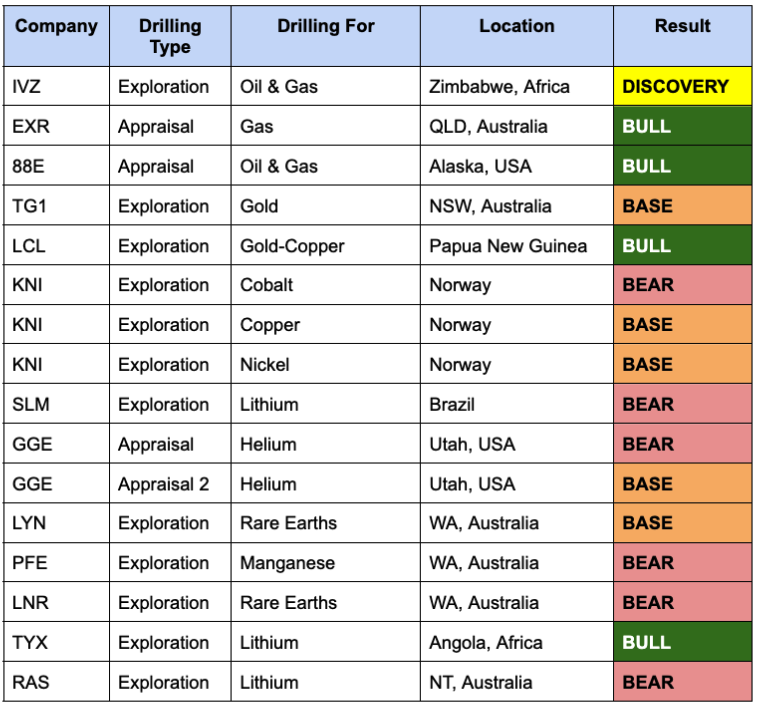

Results Matter: How did our company perform?

Key Drilling Results

We like to Invest in high-risk, high-reward exploration stocks, both across oil & gas, as well as minerals exploration.

The “drill results” are the most important factor for any exploration investor, as it gives the most accurate information as to whether or not the company has discovered something material.

For each of our Portfolio companies drilling campaigns we like to set a “bull/bear/base” case scenario BEFORE the drilling occurs, to evaluate if the drilling was a success in our opinion.

Here are the key drilling results that our Portfolio Companies published in 2023:

A quick word on NHE, the results are currently sitting in our “BASE” case scenario, but we are awaiting for the final results to see if it achieves our “BULL” case.

You can see the type of hit rate on early stage exploration - exploration is hard and small cap investing is risky.

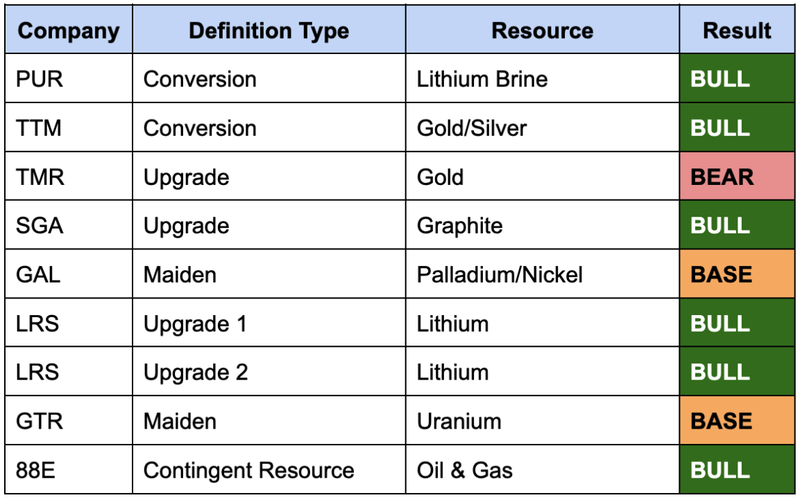

Resource Definition

Once a company makes a discovery, it needs to be defined in a JORC resource.

This resource allows the company to undertake feasibility studies to work out whether it is economic to spend the capital required to mine and sell the resource.

JORC Resources can be make-or-break for a company, and often companies will build a JORC resource over time, by continuing to “upgrade” the resource with more drilling.

Here are the companies that put out a JORC resource, and our take on the result against our bull/base/bear case:

Feasibility Studies

Before a mining project can be financed, the company will undertake a feasibility study to work out the “HOW” and “WHY” of the project.

The “WHY” can boil down to the economics of a project. If a project has favourable economics, then it is more likely to be developed.

These studies can take time (and money) to develop, and they are a strong sign of a maturing company ready for a large capital investment.

Here are the companies that published feasibility studies in 2023:

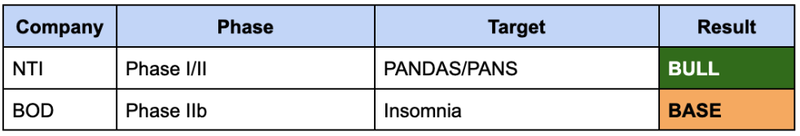

Clinical Trials

Clinical trials are the biotech equivalent of a drilling result.

They are often binary, and a good result could be game changing for the company.

A last word from us...

This is (most likely) our last newsletter for the year, we will be returning to regular content in early January.

This year we sent 190 Newsletters and 48 Weekenders, published 393 Quick Takes and 13 Educational Articles.

A big thank you to everyone who read and shared our content. It means a lot.

Enjoy the holidays and wishing everyone a happy (and prosperous) new year.

May your investments be green and stocks bullish.

And hopefully we see a return of a more active and buoyant small cap market in 2024.

Next Investors.

What we wrote about this week 🧬 🦉 🏹

Arovella Therapeutics (ASX:ALA)

Read: ALA is our best performing stock in 2023 - here’s why, and what to expect in 2024

Grand Gulf Energy (ASX:GGE)

Read: GGE Gets First Helium Flow Rate in the USA

Sarytogan Graphite (ASX:SGA)

Read: CONFIRMED: SGA has produced battery grade product

Whitehawk (ASX:WHK)

Read: $6.6M capped WHK signs US $1.2M PER YEAR contract with “Top 5 Global Social Media Company”

Quick Takes 🗣️

MAN signs DLE partnership with Bill Gates backed Electroflow

GTR drill results from US uranium project

EXR moving into flow test phase at its QLD gas project

NTI completes autism trial recruitment, two catalyst early next

Haranga starts drilling for uranium in Senegal

News Coverage 📰

US to Ban Russian Uranium Imports

Neuren Shows Biotechs can Succeed on the ASX

Gina Rinehart and SQM lob in $1.7B bid for Azure Minerals

Happy holidays,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.